“I really hate paying for this insurance, but it does help me sleep well at night knowing it is there,” is a phrase well put by one of my clients. He and his wife are both successful physicians, with children and loans to repay. The suggestions I made for them over the years will suit any specialty, but particularly neurosurgery with its higher opportunity cost and incomes to insure.

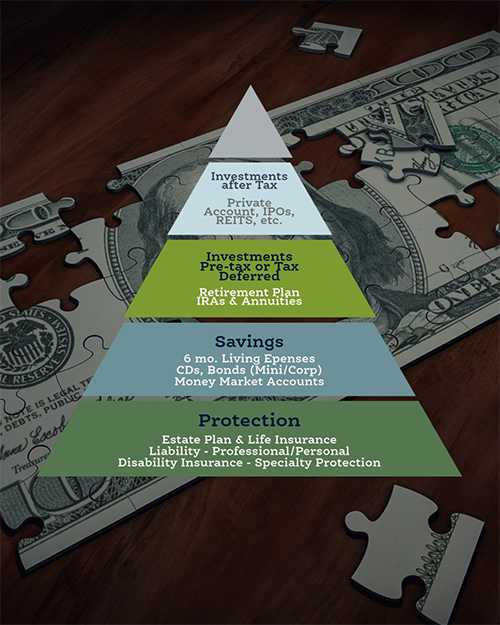

Just as a physician will not see patients without malpractice insurance, no one should be without a personal liability umbrella. Typically $1 to 3 million in coverage, affordably offered through your auto and home insurance broker, this will protect your assets and future income should something happen like a car accident and it is your fault, or your teenager’s fault, or there is an incident at your home, such as a dog bite or fall. Lawyers will try to sue for future income, so this is very important coverage, even in residency.

Residency or medical school is a great time to obtain a disability insurance policy to insure your income. The younger and healthier you are, the less it will cost. Each professional phase has certain coverage limits, and once you are finished with residency or fellowship, the benefits will be based on your income and amount of any employer based disability coverage in force. Physicians in residency and fellowship should add a future increase option, which allows them to obtain more coverage as income rises without having to go through the medical evaluation of the application. Another important benefit is Cost of Living Adjustment, which will increase your benefits by 3% per year typically, IF you are disabled and cannot work. Residual benefits will pay a partial benefit should you go back to work part time after a disability. Equally important is Specialty Protection, which means if you cannot perform the duties of a neurosurgeon, you will receive your benefits even if you are working in another capacity. Policies come with a myriad of other benefits, but these are the most important, as is the financial strength of the insurance company (A+ or higher).

Residency or medical school is a great time to obtain a disability insurance policy to insure your income. The younger and healthier you are, the less it will cost. Each professional phase has certain coverage limits, and once you are finished with residency or fellowship, the benefits will be based on your income and amount of any employer based disability coverage in force. Physicians in residency and fellowship should add a future increase option, which allows them to obtain more coverage as income rises without having to go through the medical evaluation of the application. Another important benefit is Cost of Living Adjustment, which will increase your benefits by 3% per year typically, IF you are disabled and cannot work. Residual benefits will pay a partial benefit should you go back to work part time after a disability. Equally important is Specialty Protection, which means if you cannot perform the duties of a neurosurgeon, you will receive your benefits even if you are working in another capacity. Policies come with a myriad of other benefits, but these are the most important, as is the financial strength of the insurance company (A+ or higher).

The last piece of the base of your financial portfolio is life insurance. If you have anyone depending upon you for financial stability, you need to obtain this coverage. Term insurance is the least expensive; this will remain at the same price for a limited number of years. Then, there are more expensive permanent types without term limits; these build cash value. I suggest 10 times annual income, or $1 Million per child. BUT everyone has a different circumstance and needs. Along with life insurance, a good estate planning document is wise, again, if there is anyone depending on you financially. A basic will is fine, better yet is a trust that will hold the assets of the estate for the beneficiaries. Included in these documents will be health care and financial power of attorney, guardianship designations for minors and health care directives.

The truth is, if you talk to five different financial professionals, you may get five different suggestions. The base of your financial portfolio needs to fit your budget and, most importantly, like my client said, your plan needs to help you sleep well at night knowing it is there.

Building a Successful Portfolio

Basic Principals

- Save 15-25% of Gross Income

- 60% of Portfolio Invested Conservatively

- 5-10% for Speculation

- Monitor Liabilities

[aans_authors]