Creation of Accountable Care Organizations (ACOs) is a central policy goal of the Affordable Care Act (ACA) passed in President Obama’s first term. The purpose is to develop large provider organizations to reduce healthcare costs, improve the patient experience and improve the quality of patient care.

ACOs are a growing part of the healthcare landscape, with two important trends:

Concerted payment reform. The U.S. Department of Health and Human Services (HHS), in its Jan. 26, 2015, announcement set explicit goals of “tying 30 percent of traditional, or fee-for-service, Medicare payments to quality or value through alternative payment models, such as ACOs or bundled payment arrangements, by the end of 2016 and tying 50 percent of payments to these models by the end of 2018 (1).”

- Rapid growth of ACOs in the healthcare marketplace. In Q1 of 2011, there were 64

ACOs in the U.S., and as of Q1 of 2015, there were 744. Enrollment in ACOs grew from 2.6 million to 23.5 million over the same time period, resulting from governmental and commercial efforts (2).

ACOs are defined as “groups of doctors, hospitals and other healthcare providers who come together voluntarily to give coordinated high quality care to their Medicare patients. The goal of coordinated care is to ensure that patients, especially the chronically ill, get the right care at the right time, while avoiding unnecessary duplication of services and preventing medical errors (3).”

The three ACO models under the direction of Centers for Medicare & Medicaid Services (CMS) are:

- Medicare Shared Savings Program (MSSP): allows Medicare fee-for-service providers to participate in an ACO;

- Advance Payment ACO Model: allows participants to be paid via fixed and/or variable up-front monthly payment (closest to a capitated payment system); and

- Pioneer ACO Model: allows for higher level of shared savings and losses.

Other types of organizations have also developed their own ACO models, including commercial insurance companies, Medicaid, large businesses and state agencies.

Common Elements

Elements common to all ACOs include:

- Innovations in provider payment models, including shared savings and other types of payment models, that incentivize providers to move away from traditional fee-for-service payment systems;

- Quality indicators that typically impact the amount of shared savings or losses;

- Access indicators for professional practices that can impact the amount of shared savings or losses; and

- Patient experience surveys, typically via the Consumer Assessment of Healthcare Providers and Systems (HCAHPS).

Providers and Systems Survey Tool

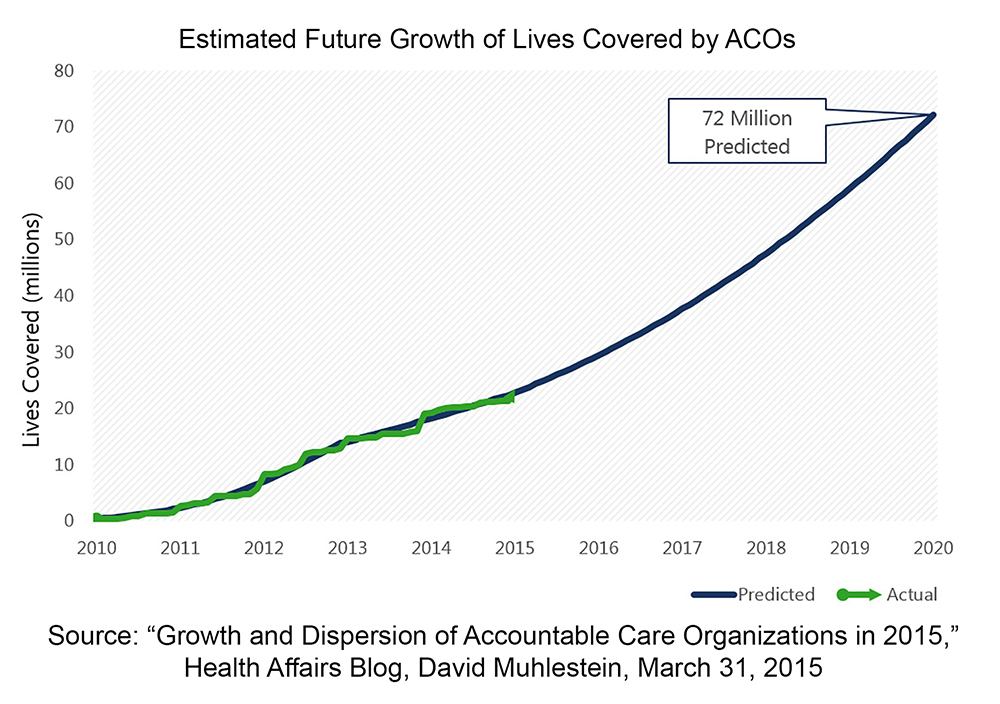

Many authors predict a large growth in ACOs in the near future (Figure 1). With the 2016 presidential election, growth predictions via the Federal government are difficult. However, it would be unwise to assume that a change in administration would slow the growth of commercial or Medicaid ACOs as pressure to dull growth in the cost of healthcare increases.

In a press release published in August 2015, the CMS stated, “Since passage of the Affordable Care Act, more than 420 Medicare ACOs have been established, serving more than 7.8 million Americans with Original Medicare as of Jan. 1, 2015.” The release also included the 2014 results for the two ACO programs that started in 2012 — the MSSP and the Pioneer ACO Program. Overall, 27 percent of these Medicare ACOs earned incentive payments by meeting their minimum savings threshold. In 2014, the ACOs’ overall net savings for Medicare was $411 million. The data also showed improvement in the vast majority of quality measures from the prior year. Another important finding was that the older the ACO, the better it performed in generating savings and in quality measures — a potentially strong indicator that ACOs will continue to play a larger role in transforming the healthcare market.

One example has been the progression of ACOs in Michigan. It first started when the University of Michigan’s Faculty Group Practice participated in a Medicare demonstration project in 2005, and by 2011, it had become the prototype for the ACO movement. The demonstration project saved Medicare more than $22 million while exhibiting improvement in the quality of care. In 2012, the University of Michigan Health System (UMHS) began participating in a Pioneer ACO model in partnership with a local multi-specialty group practice. In one year, the Pioneer ACO achieved cost savings for Medicare and was able to improve quality measures.

Meanwhile, in 2013, a separate new MSSP ACO, the Physician Organization of Michigan ACO (POM-ACO), began efforts to improve care for Michigan Medicare participants and help the CMS contain cost growth. POM-ACO is a physician-led partnership of over 6,300 Michigan providers among 12 physician groups that care for over 133,000 Medicare-enrolled patients. By working together, POM-ACO provides better care for patients, better health for populations and lower overall healthcare costs.

POM-ACO utilized experiences from UMHS. UMHS supported the start-up costs for POM- ACO, and it later expanded in 2014 as UMHS ended its Pioneer ACO and transitioned its physician members to POM-ACO. It should be noted that the vast majority of physicians within POM-ACO had previously embraced quality initiatives sponsored by private insurers, such as Blue Cross Blue Shield Michigan’s Physician Group Incentive Program and the Michigan Primary Care Transformation Project.

Consequently, physician readiness to participate in programs that improved patient care was already established. In September, POM-ACO reported its second year results, saving more than $27 million in Medicare spending, thus earning its savings share of over $12 million to use for further quality care improvements.

Growth and Progression

So why is the growth in ACOs important to the neurosurgical community? From a healthcare business perspective, the primary reasons are related to market forces. First, a physician network strategy is essential. ACOs are incentivized to enroll as many patients as manageable; thus, they heavily recruit primary care physicians (PCPs) into their network. If your practice does not participate in an ACO, or have strong physician relationships and arrangements, you could risk losing the lifeblood of your practice — PCPs — to your competitors. PCPs that operate within an ACO send referrals to participating specialists. Second, when — not if — payment reform happens, PCPs will be essential to a physician network strategy as value-based contracts and payments are established in your market.

To Join or Not to Join?

In the 2014 NERVES Socio-Economic Survey, 24 percent of 90 respondents indicated that their practice is participating in an ACO, of which 59 percent had been participating for more than one year. We recently gathered additional input from the NERVES membership regarding ACOs, and their ideas and thoughts follow:

As a specialty surgical practice, the main reasons to participate in an ACO, include:

- Protecting market share

- Possible upsides on shared savings

- As an ambulatory surgery center or radiology service, you could be sought after as your cost of care is probably less than that of a hospital, which is typically running the ACO.

- A hospital probably needs you for network access purposes, so you might have some leverage to use with other issues.

- It meets the requirement for successful participation in Physician Quality Reporting System (PQRS).

- Access to cost and quality data from the ACO that might not otherwise be available

As a specialty surgical practice, the main reasons not to participate in an ACO include:

- Potential downside risk – carefully read affiliation agreements

- Potential cut in fee-for-service reimbursement – carefully read the agreements

- Determine if participation is exclusive when more than one ACO resides in your marketplace. Systems want “exclusivity;” however, Federal guidelines specifically allow specialists to join as many as they desire for Medicare sponsored ACOs. Commercial payors and purchasers can and do limit participation in their ACO networks.

- Physicians may not agree to clinical guidelines, and quality reporting may incur substantial staff time on a monthly, quarterly or annual basis. The ACO may also have access to care requirements, such as appointments, within 10 days for non-urgent visits and 24 hours for urgent visits.

Not all ACOs are created equal. Use due diligence to ensure confidence in the ACO and their chances of success by considering the following:

- Is the ACO completely run by the hospital or independent physicians?

- How much input do physicians have? It is critical to ensure physicians are onboard to provide the best patient protocols and outcomes as a result along with corresponding upside in payment.

- Some ACO models have no downside risk, while others may have significant risk. Ensure limited risk from the payment perspective. Start with a small risk component, such as 5 percent, then consider an increase after a year or more if comfortable. Payment risk should have both an outcome-based upside in addition to a downside.

- Beware if you are requested to join an ACO where quality measures, reimbursements or risks associated with the agreement are undefined.

CMS says interest in ACOs is rising and continued growth in participation is expected. Just as we are beginning to understand current ACO models, CMS is rolling out new models in hopes of attracting more providers who are uneasy with the current models. In the new models, patients will be able to opt-in and pay reduced or no out-of-pocket payments for certain services. One new model has four payment systems and two risk tracks; one of which is almost 100 percent risk. Needless to say, ACOs are here and will continue into the foreseeable future as the transformation of healthcare continues. The key will be how we navigate and position our practices in an era of population healthcare change.

References

1. https://www.hhs.gov/news/press/2015pres/01/20150126a.html

3. https://www.cgov/Medicare/Medicare-Fee-for-Service-Payment/ACO/index.html)

[aans_authors]